Allowance for Doubtful Debts Double Entry

Bad debts and specific doubtful debts with any subsequent recovery being treated as income when received. Debt Write-off Regulations 1994 pursuant to section 251 for the FAA Scenario A - Sale of.

Allowance For Doubtful Accounts Debit Credit Journal Entry

If you are doubtful about something you are uncertain about it.

. Accounting Journal and Ledger Quiz. Recovery of debts due to estate A trustee shall in the notification of his appointment in the Gazette in terms of subsection 3 of section 56 call upon all persons indebted to the estate of which he is trustee to pay their debts within a period and at a place mentioned in that notice and if any such person fails to do so the trustee shall forthwith. B-1 Organic Food Company B-1 engages in the business of selling organic food on-line.

When specific bad debts are identified you then debit the allowance for doubtful accounts and credit the accounts receivable account. The accounts receivable test is one of many of our online quizzes which can be used to test your knowledge of double entry bookkeeping discover another at the links below. Allowance for Doubtful Accounts has a credit balance of 1000.

Description of Journal Entry. When the balance in this account is combined with the balance in Accounts Receivable the resulting amount is known as the net realizable value of the receivables. Enter the email address you signed up with and well email you a reset link.

Entries 2c and 3 have been added to present the recording of an allowance for doubtful accounts and the write-off of the loan receivable. When given a choice between several outcomes where the probabilities of occurrence are equally. On December 31 2019 an entity declared a cash dividend payable March 31 2020.

Shares that have been issued are those that the owners have elected to sell in Q. In accounting the convention of conservatism also known as the doctrine of prudence is a policy of anticipating possible future losses but not future gainsThis policy tends to understate rather than overstate net assets and net income and therefore lead companies to play safe. Allowance for doubtful debts.

After writing off the bad account on August 24 the net realizable value of the accounts receivable is still 230000. Employers contributions to approved pensions or provident funds. Allowance for doubtful debts.

Example Expense Journal Entries. Owner invested 10000 in the company. To record cash received after an accounts receivable has been written off.

Interest on a 3-month 10 percent 10000 note receivable is A. Named as Super Vasuki - runs on 15th August 2022 75th Independence Day Anniversary As per mythology Vasuki is famous for coiling around Shiva s neck who blessed and wore him as an ornamentVasuki took part in the incident of Samudra Manthana by allowing both the devas and the asuras to bind him to Mount Mandara so that they could use him as their churning rope to. Note that prior to the August 24 entry of 1400 to write off the uncollectible amount the net realizable value of the accounts receivables was 230000 240000 debit balance in Accounts Receivable and 10000 credit balance in Allowance for Doubtful Accounts.

Click to see the answer. When setting up or adjusting a bad debt reserve debit bad debt expense and credit the allowance for doubtful accounts. The Allowance for Doubtful Accounts is used under the allowance method of.

Lower of Cost or Market LCM Investments in Debt and Equity Securities. Try Another Double Entry Bookkeeping Quiz. Enter the email address you signed up with and well email you a reset link.

Special provision regarding interest on bad and doubtful debts of financial institutions banks etc. The Allowance for Doubtful Accounts is a contra-asset account since its balance is intended to be a credit balance or a zero balance. Allowance for doubtful accounts Impairment of a Loan.

Eg Tabung Amanah Pekerja TAP or Supplement Contributory Pension Fund SCP vi. To use the allowance for doubtful debts to write off an accounts receivable. First In First Out FIFO Last In First Out LIFO Dollar Value LIFO.

When an act of the legislative department is seriously alleged to have infringed the Constitution settling the. An allowance for bad debts can either be established as a percentage of accounts receivable or by setting up an aging schedule. Zakat fitrah or any religious dues payment of which is made under any written law.

Allowance for doubtful accounts entry. Indeed this CMP entry brings to fore that the real issue in this case is whether paragraph 4 of Section 2 of Article XII of the Constitution is contravened by RA 7942 and DAO 96-40 not whether it was violated by specific acts implementing RA 7942 and DAO 96-40. Categories of bad or doubtful debts in the case of a public company under clause b of section 43D.

If management estimates that 5 of Accounts Receivable will prove uncollectible Bad Debts Expense would be recorded for A. Accounting Debit and Credit Quiz. If a situation is doubtful.

Books of account and other documents to be kept and maintained under section 44AA3 by persons carrying on certain professions.

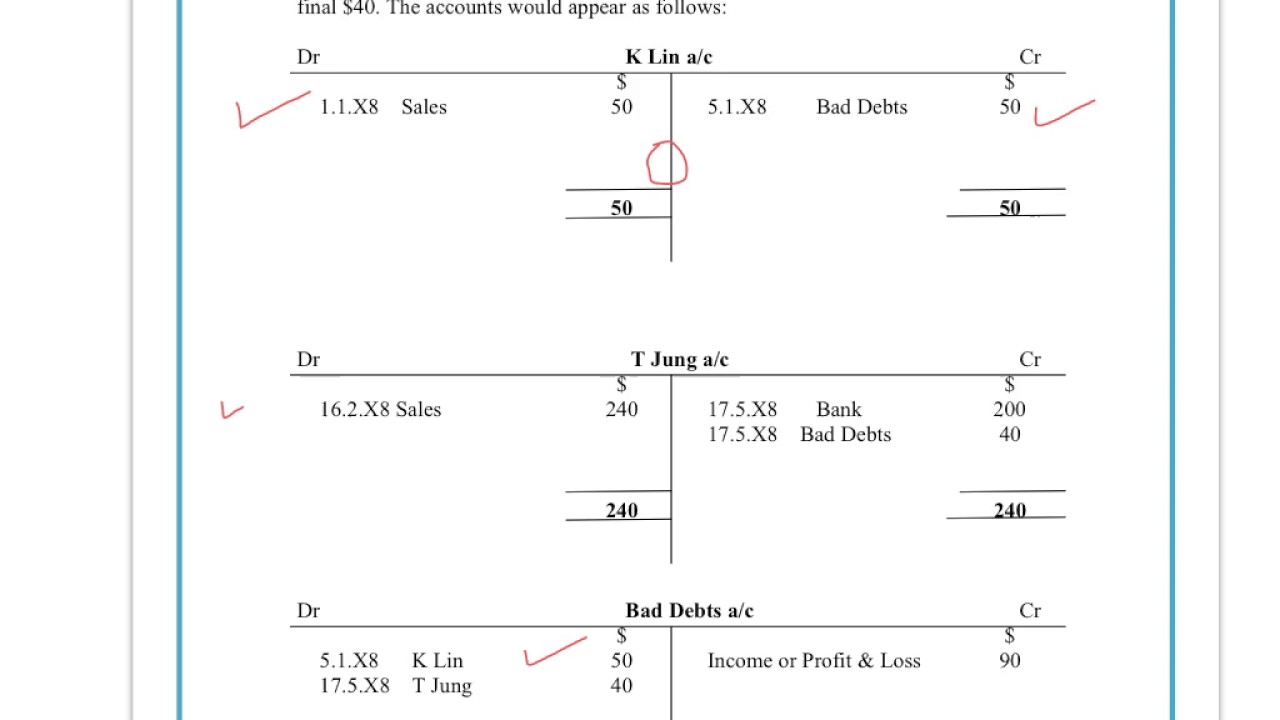

Igcse Gcse Accounts Understand How To Enter Bad Debts Transactions Using The Double Entry System Youtube

Allowance For Doubtful Debt Level 3 Study Tips Aat Comment

Writing Off An Account Under The Allowance Method Accountingcoach

Allowance Method For Bad Debt Double Entry Bookkeeping

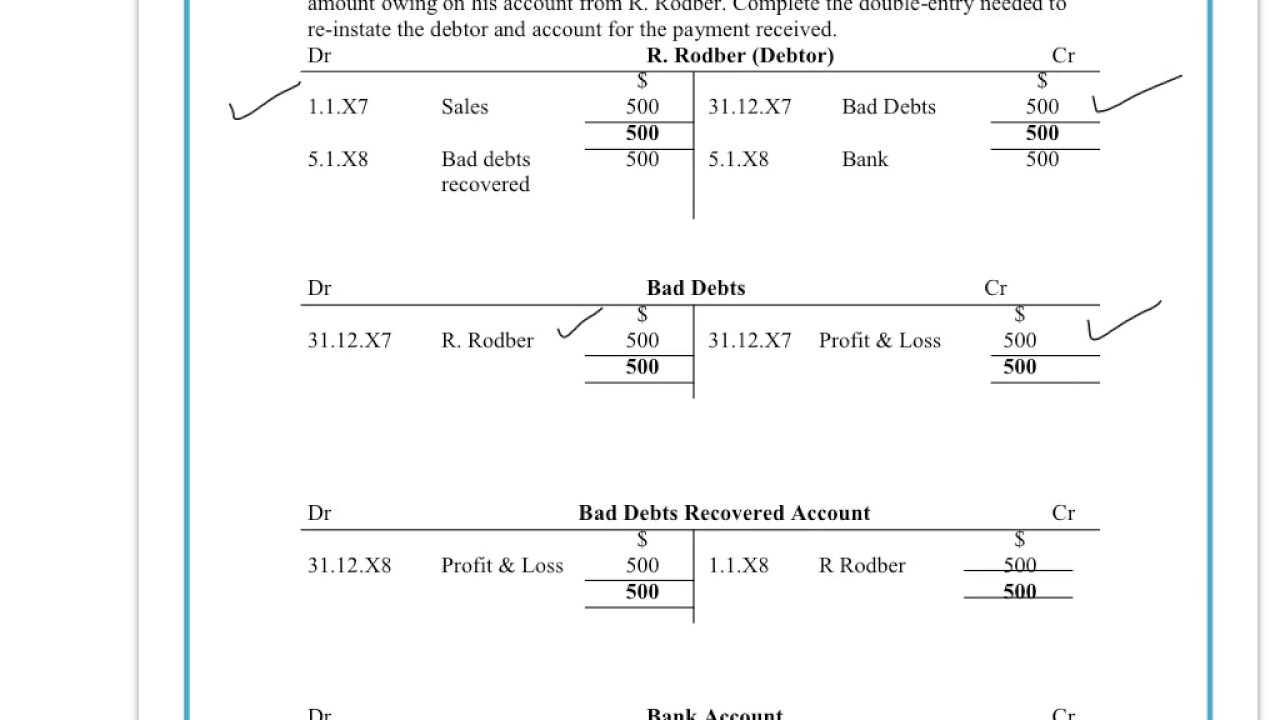

Understand How To Enter Bad Debts Recovered Transactions Using The Double Entry System Youtube

Comments

Post a Comment